For many pet owners in Hong Kong and around the world, pets are more than just animals, they are beloved members of the household. Just as we purchase health insurance policies for ourselves and our families, ensuring that our furry friends have medical coverage for emergencies is equally very important. Emergency vet visits due to illness or injury can be expensive, and the last thing any dedicated pet parent ever wants is to feel unprepared when the cost of treatment is presented.

Unfortunately, pets are always at risk of falling ill or getting injured due to unexpected situations. Veterinary costs can pile up quickly during an emergency, placing a huge financial burden on you. There are so many pet insurance plans on the market that you may be feeling overwhelmed trying to find one that meets your pet’s needs as well as your budget. With varying premium structures, coverage limits, deductibles, and exclusions, exploring pet insurance options can feel like a massive work.

If you’ve been considering pet insurance, this guide covers everything you need to know about pet insurance in Hong Kong. From the basics of how it works to what it covers and what affects the price, we cover everything you need to know. In the end, you’ll have a solid understanding of how to protect your pets and keep those vet bills down.

What Is Pet Insurance & How Does It Work In Hong Kong?

Pet insurance is a specific policy that helps you pay for unexpected vet bills. Similar to human health insurance, pet insurance offers a layer of financial protection against pricey medical expenses, surgeries, and emergencies for pets. With the rising cost of veterinary care, having a dependable pet insurance plan guarantees that your furry friend obtains the best treatment possible without breaking the bank.

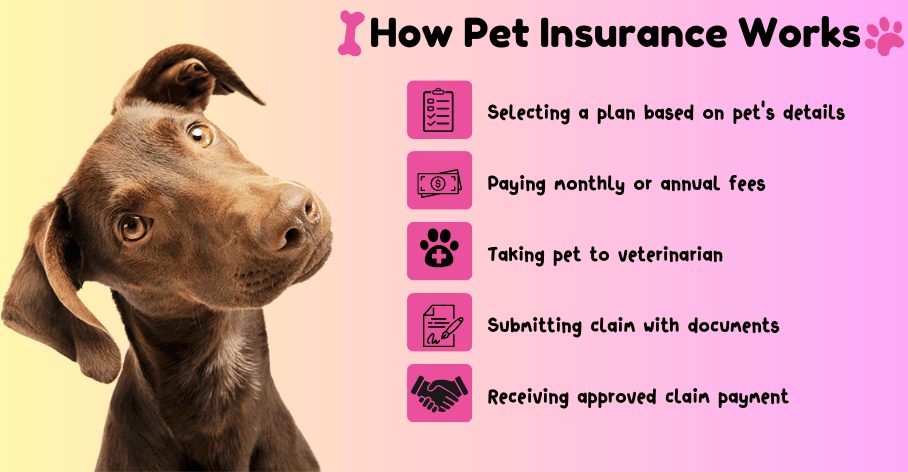

Most Hong Kong pet insurance policies typically cover accident treatments, illness, hospitalization, and, in some cases, routine care. You should try to understand how pet insurance works, as it can help you make better decisions while choosing a policy.

- Choosing a Policy: You choose a plan based on your pet’s breed, age, and medical history. Plans vary in coverage limits, deductibles, and premiums.

- Premium Payment: You pay monthly or annual payments to maintain coverage. The expense varies depending on the pet’s age and breed and the level of coverage you choose.

- Receiving Services: When a pet falls ill or gets injured, you take it to a licensed veterinarian for care.

- Post-Payment and Claim Submission: You pay for the treatment upfront and then submit a claim to the insurance provider along with the necessary medical records and receipts.

- Reimbursement: After the approval is obtained, the insurance provider will reimburse a certain percentage of the eligible medical expenses, typically between 70% and 100%, as per the policy.

Some overseas pet insurers offer direct billing so payments can be sent directly to the veterinary clinic, reducing your cost. However, this varies with the individual policy and provider.

What Pet Insurance Covers

Pet insurance in Hong Kong protects your furry companion, covering accidents, injuries, and common illnesses, including infections, cancer, diabetes, and kidney disease. Most policies cover emergency treatments, hospital stays, surgeries, and diagnostic tests like X-rays, MRIs, and blood tests to ensure accurate diagnoses. Some plans also include third-party liability coverage if your pet injures a person or damages property. Some policies also cover end-of-life expenses, like euthanasia and cremation, helping you make painful decisions without the worry of expensive costs.

Most providers also offer optional add-ons to widen coverage, such as routine vet checkups, vaccinations, flea and tick prevention, and descaling. Some policies cover hereditary and congenital health problems, particularly in breeds with a genetic predisposition to certain conditions. Alternative therapies such as acupuncture, hydrotherapy, and physiotherapy are also becoming popular, but not all plans cover them, so check the fine print.

Knowing what’s covered is just as important as knowing what’s excluded. Pre-existing conditions are generally not included, and some policies exclude certain breeds, especially those with hereditary problems. Basic plans typically do not cover routine care unless otherwise noted. Finding the right pet insurance means weighing coverage and exclusions to receive the best treatment without a financial hit. Researching will save you stress and money while keeping your pets happy and healthy.

Is Pet Insurance Worth It?

Yes, pet insurance is a worthwhile investment for pet owners in Hong Kong due to the high cost of veterinary care. Unexpected accidents or illnesses can lead to high medical bills, and insurance allows pet owners to provide necessary treatment without going broke. Pet insurance provides coverage for emergencies, surgeries, and routine check-ups, giving you the ability to provide your pet with the best possible healthcare options and improving their quality of life. Moreover, insurance gives you peace of mind and allows you to afford treatment if your pet gets sick. Some policies even cover third-party liability, so if your pet injures someone or damages their property, it doesn’t leave you exposed to legal fees. That makes it cheaper, with lower premiums and can save your pet’s life and money over the long run.

What is the Cost of Pet Insurance in Hong Kong?

The average cost of pet insurance in Hong Kong ranges from HK$100 to HK$400 per month, depending on various factors. The biggest is your pet’s age — young pets are cheaper to insure because they tend to be healthier, while older pets have higher premiums as the risk of poor health increases. Some dog breeds have a genetic tendency towards certain conditions. For example, German Shepherds and Labrador Retrievers can both have problems with joint issues, whereas small dog breeds like Chihuahuas and Dachshunds tend to suffer from dental problems. These health issues can affect the price of coverage.

The scope of coverage also affects pricing—basic accident-only plans are relatively cheap, while comprehensive plans that cover illnesses, wellness care, and alternative therapies are more expensive. Add-ons such as routine checkups, dental care, or acupuncture can raise premiums further.

Your deductible selection affects your monthly costs. A higher deductible lowers your premiums, while a lower deductible increases them. However, a lower deductible provides more financial coverage if a covered event occurs. A pet’s claims history matters, too. Those with previous medical problems are charged higher premium rates, while some insurers offer discounts to those without a history of medical problems.

Things to Consider When Buying Pet Insurance

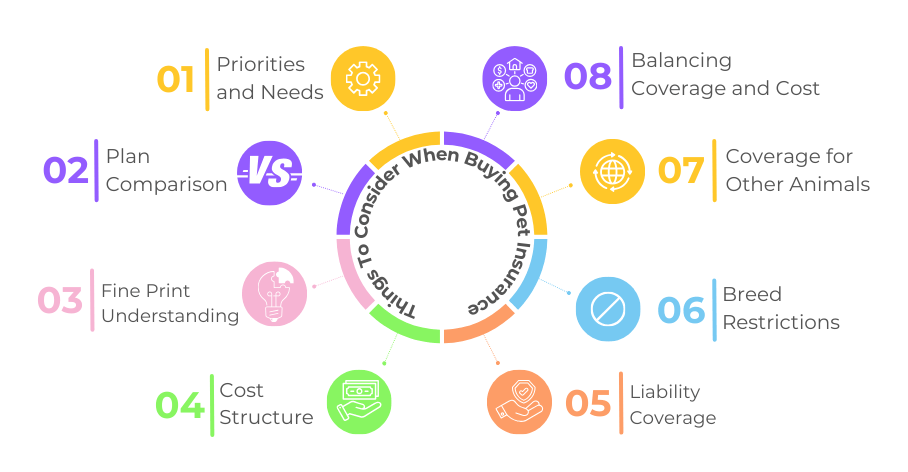

If you’re considering buying pet insurance, there are some important things to think about to ensure you choose the best plan for you and your pet friend.

- Determine your priorities and pet’s needs: Spend time reflecting on what matters most to you and your pet. Consider the kind of coverage that best meets your pet’s age, breed, health issue, and specific needs.

- Review multiple pet insurance plans: Compare different policies to see what’s available. This allows you to evaluate coverage and costs and find a plan that best suits you and your pet. Policies vary, and researching several provides a better idea.

- Understand the fine print: Read each plan’s terms carefully. Policies have varying inclusions and exclusions, so familiarizing yourself with them in advance helps you avoid surprises when you need to file a claim.

- Clarify how deductibles, premiums, and co-payments work: Make sure you know how much each plan costs. Get accustomed to terms like deductibles (the amount you must pay out of pocket before coverage begins), premiums (monthly payments), and co-payments (your share of the medical expenses). These costs can increase as your pet gets older; be sure to consider them.

- Look for third-party liability coverage: Some policies cover your cost in case your pet damages someone else’s property or injures a person.

- Verify breed restrictions: Not all insurers cover all breeds.

- Check coverage for other animals: If you have pets other than a cat or dog (e.g., birds, reptiles, exotic animals), ensure the policy covers them as well. Many insurers cover only cats and dogs, so you’ll have to find one that covers other animals if you have them.

- Balance coverage, cost, and comfort: Getting the right pet insurance is all about balancing coverage and cost. The policy should include enough coverage for all the needs of your pet but also be affordable within your budget. You don’t want to be overwhelmed by increasing expenses, particularly as your pet gets older or needs extra medical treatment.

- Take your time to do research: Don’t rush the process of deciding on your insurance policy. You should always compare prices, read reviews, and fully understand the terms to make an informed decision that’s best for you and your pet.

Conclusion

Choosing the right pet insurance in Hong Kong ensures your furry companion’s health without the worry of high expenses. Always compare plans, coverage, costs, and benefits to choose what best suits your pet. Purchasing pet insurance now can save you on expensive vet bills later.

Pet insurance also gives you peace of mind that your pet can receive excellent medical treatment without breaking the bank. Whether you own a puppy fresh out of its teen, or a cat in its golden years, there is an array of plans available to choose from. Dedicating time to research, comparing policies, and selecting the right provider can’t be ignored if you want your pet and you to have a healthier and worry-free way of life in years to come.

FAQs

Where Do You Find Pet Insurance?

You can purchase pet insurance for your pets in Hong Kong through various insurance providers, including OneDegree, Blue Cross, and Prudential. Through comparison websites such as MoneySmart, you can explore and compare plans to see which is best for your pet based on coverage and cost. Moreover, online marketplaces give easier access to different insurance providers, which makes it easier to compare the options offered and select the best plan for your pet.

What Is The Best Pet Insurance Plan?

The best pet insurance plan depends on your budget and your pet’s health needs. A good plan will have a good reimbursement rate (some insurers reimburse for up to 90% of medical costs), a wide coverage that will cover accidents, illnesses, and hospitalization, and reasonable limits on annual claims so as to help ensure coverage. Equally important, examine if exclusions apply, such as pre-existing conditions, hereditary diseases, or age restrictions. Choosing a plan that fits your pet’s specific healthcare needs will be the one that provides the most value.

When Is The Best Time To Get Pet Insurance?

For the best price on pet insurance, you want to sign your pet up as early as possible, ideally while they’re young and in good health. Younger pets have lower premiums, and insurers are less likely to apply restrictions on coverage for pre-existing conditions. If you wait to get insurance until after a pet has health issues, coverage will be limited or premiums higher. If you adopt a pet from a breeder or a rescue shelter, you should get pet insurance that covers your new pet immediately to avoid paying out of pocket for unexpected medical expenses.

How Long Does Pet Insurance Take To Kick In?

Pet insurance in Hong Kong usually has a waiting period before the coverage is in effect. The waiting period for accident coverage is generally immediate or 24 hours. Some insurers have a 14 to 30-day illness coverage waiting period. Some insurance companies will also have extended waiting periods for certain medical concerns like hip dysplasia or hereditary diseases, which can take up to six months before the insurance starts to cover them. It is important to read the policy terms closely to know when coverage starts and to plan accordingly.

Is microchip required?

In Hong Kong, all pet insurance companies require pets to be microchipped for identification. Microchipping is essential for proof of ownership, enabling the timely processing of claims, and preventing fraud. Insurers will only accept a policy or claim if your pet’s microchip information matches their records. Microchipping is a permanent form of identification that helps to improve the chances of recovering lost pets, which is a great benefit to pet owners.